Key Steps to Selling Your Business – A Roadmap

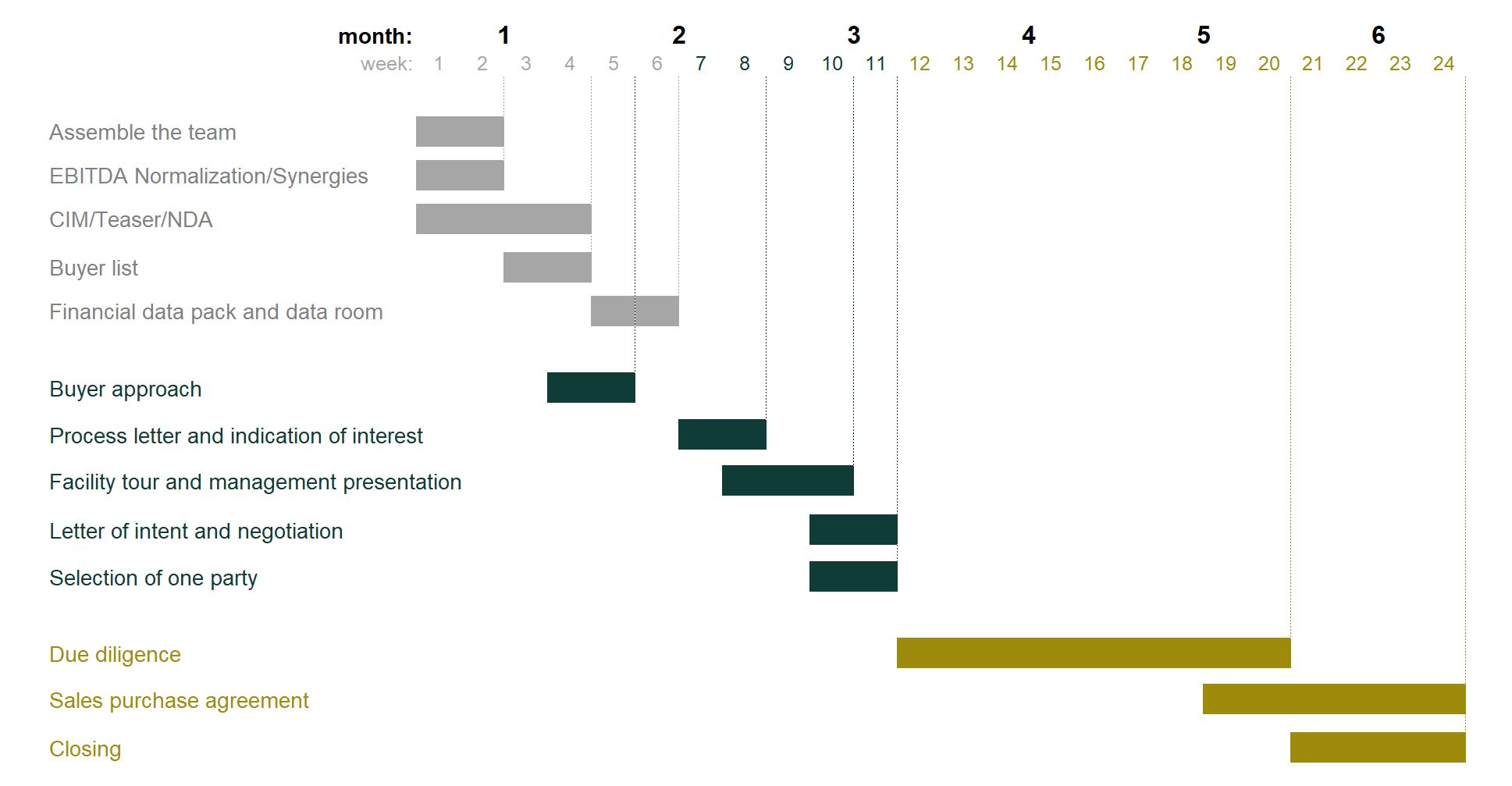

The key steps to selling your business successfully are illustrated in this complete roadmap and timeline.

Business owners looking to sell their business frequently ask us what the steps and roadmap are to a successful transaction. This newsletter summarizes the key steps in a structured sale process, from initial preparations prior to sale to post-closing adjustments, and describes how an investment banker will act as a quarterback at all stages to ensure a successful transaction.

The following illustrates a competitive and comprehensive formal sales process to maximize the seller’s position, however, the investment banker may adjust his approach to meet a client’s specific criteria, such as a desire for a more limited, simple and less robust approach. Cafa will be pleased to assist you as an investment banker for your sales project by following the best approach that satisfies your comfort level. Contact one of our associates to initiate the dialogue.

Assemble the team

A sale process should only occur once. Being prepared and having your team and game plan in place before you get started can avoid false starts, an aborted deal, and other disappointments.

Lawyer and Tax Specialist

The first step is to assemble a team of professionals that will include, among others, a lawyer and a tax specialist with experience in M&A transactions. These two professionals will advise the seller of any corporate and tax reorganization required to optimize the proceeds of disposition.

Investment Banker

It is equally important to hire an investment banker free of conflicts of interest (such as financing the buyer or auditing the post-transaction company) and of good reputation to act as quarterback and lead the entire sales process. Depending on certain situations, professionals with cross-border experience will be required. Read more about the what to look for in an investment banker in our newsletter The Investment Banker – Benefits and How to Choose the Right One.

Accountant

Beyond the review of the tax strategy, a seller should consider mandating the preparation of a Quality of earnings report prior to the marketing the business. This report will allow to: a) present the company in its best light, b) know from the outset the concerns that a buyer might raise (and attempt to renegotiate) during the process, and c) absorb a large part of the due diligence workload before it begins. See our newsletter: Benefits of a Vendor Due Diligence for a more detailed explanation.

Other Professionals

Depending on the nature of your business, size of the transaction, type of assets, etc. you may also need the assistance of other professionals. Such specialists might include certified appraisers, real estate professionals, environmental auditors, engineers, human resource and employee benefits experts, actuaries, and others. Some of these experts may be hired directly by you or may be subcontracted by your principal advisors.

Analysis of Financial and Operational Information

The investment banker will begin his mandate with a list of requests for information that will allow him to fully assimilate the nature of the company, its operations, the sector of activity, the clientele, its growth opportunities, its competitive advantages, an analysis of its competitors and, above all, its value. This understanding of the company will allow the investment banker to create a narrative that will present the company in its best light to buyers who are likely to appreciate its value. Following his analysis, the investment banker will indicate to the seller the realistic value of the business based on an analysis of the multiples paid for comparable transactions (or the price of public companies), or other valuation methods as may be relevant. Like the accountant’s quality of earnings report, the investment banker’s preparation work will raise certain issues and the seller will have an opportunity to resolve these issues early in the process. Our newsletter The Process of Selling Your Business more fully describes the overall process; What is your business worth? provides information on commonly used valuation methods.

EBITDA Normalization and Identification of Synergies

With financial data in hand, the investment banker will work with the seller to identify of all possible EBITDA adjustments. As explained in our newsletter EBITDA Multiple Valuation for Determining Enterprise Value, certain revenues and expenditures must be removed or added back to “normalize” a company’s EBITDA to more accurately reflect true earning potential. The investment banker will also identify synergies a strategic buyer could capture to his benefit. Also see our The True Value of Your Business – Normalized EBITDA and Synergies newsletter.

Analysis of Working Capital

The investment banker will next analyze the company’s monthly working capital over twelve or more months to determine the target working capital to be delivered to the acquirer at closing. Proper determination of the company’s minimum working capital will be key in negotiating the payment mechanism of any excess or shortfall of the required working capital delivered at closing. See our newsletter Minimum Working Capital Threshold in M&A Transactions for further insight.

Preparation of the marketing materials (Teaser, NDA, Process Letter, CIM)

Based on discussions and the information provided by the vendor, as well as market research, the investment banker will then prepare the necessary documents to market the company. These would include, by order of disclosure to prospective buyers:

- an anonymous executive summary not requiring a non-disclosure agreement (“Teaser”),

- a Non-Disclosure Agreement (“NDA”),

- a Process Letter and

- the Confidential Information Memorandum (“CIM”).

Identification and Approach of Potential Acquirers

The investment banker would then research and identify potential buyers according to a set of predefined criteria, and with input from the seller, establish a comprehensive list of buyers to be contacted. These may include local and/or foreign strategic and/or financial acquirers. Following final vendor validation of the list, targets would then be approached through a formal and confidential manner beginning with the Teaser which contains enough general data to interest an acquirer while not necessarily identifying the business being sold. The Right Buyer for Your Company and Selling Your Business – The European Advantage provides additional reading on this topic.

Preparation of the Financial Data Pack and Virtual Data Room

In parallel to the above, the investment banker will prepare a financial data pack and organize a virtual data room. The data pack and the virtual data room will only be shared at a later stage in the process to those acquirers having submitted a competitive preliminary non-binding offer acceptable to the vendor.

The Process Letter and Review of Non-binding Preliminary Offers

Based on the information in the Teaser, interested acquirers will be asked to execute the NDA whereupon they will receive the CIM and the Process Letter. The latter will set out the deadlines and the requisite conditions to submitting a successful preliminary, non-binding indication of interest. The contents of the CIM are typically sufficient for a suitor to formulate a fairly precise expression of interest for the value being offered. The investment banker should handle all communications and, as required, respond to questions, and may provide additional information as may be requested.

Indications of interest will be reviewed, compared, and discussed with the vendor from which a limited number of suitors will be selected to move forward. In certain circumstances, further discussions may take place with a suitor to better clarify or enhance their Indication of Interest. Please see our newsletter Indications of Interest, Letters of Intent, Sale/Purchase Agreements for the difference between these important step documents.

Preparation of the Management Presentation Document and Coordination of Meetings

Parties having proposed a competitive initial offer in their Indication of Interest will be invited to attend a management presentation, whereby the seller and other members of its management team will explain the company’s operations, discuss noteworthy growth opportunities, and have a constructive dialogue with the potential buyer. In addition to providing relevant information to the interested buyer, this meeting is also intended to evaluate the chemistry between the buyer and the seller – a factor of great importance not to be underestimated before committing to sell to a potential buyer. At this point, acquirers and their acquisition team will be given access to a limited amount of information the virtual data room and the financial data pack.

Negotiation and review of binding Letters of Intent (“LOI”)

Following the management presentations, potential buyers will be given a reasonable amount of time to complete a preliminary due diligence and submit a binding letter of intent (“LOI”) by a given deadline. With the seller’s participation, the investment banker will negotiate the LOIs obtained to achieve the best possible offer.

The investment banker has several databases as well as in-depth expertise to negotiate LOI clauses that meet current market conditions, notably for the purchase price structure, representations and warranties (including ceilings, terms, baskets, amounts in escrow), a working capital mechanism and deadlines to be met.

A detailed comparative analysis of the LOIs with its final recommendation will then be prepared with the final choice being up to the seller. In cases where offers fall short of vendor expectations, earnouts may prove to be a viable solution; to find out more, read our The Earnout Clause – Closing the Gap in Valuations for M&A Deals newsletter.

Coordination of due diligence and review of all documentation (legal, fiscal, etc.) until closing

Once an LOI has been executed with a buyer, complete access will be given to financial, operational, environmental, and fiscal information in order to conduct a formal due diligence. The investment banker will coordinate the sharing of information through its secure virtual data room. Please see our example of a detailed due diligence checklist.

Legal and other closing documentation

Although the vendor will rely on his legal advisors for the review of the transaction documentation, the investment banker typically participates in the process to offer “business experience” and to ensure that the final transaction reflects the original spirit of the transaction anticipated by the vendor.

Direction of payments and finalization of “post-closing” adjustments

A Disbursement Schedule will be prepared by the investment banker prior to closing. After closing, the parties would typically have 60 to 90 days to deliver the closing financial statements. Once the closing financial statements have been completed, post-closing adjustments are prepared and paid out as may be required.

Release of Escrow

In most transactions where representations and warranties insurance is not available, the investment banker should follow up with the parties on the release of any escrow amounts. These escrow amounts could be released in stages or all at once over a twelve-to-twenty-four-month period. (Our Representations and Warranties Insurance in M&A Transactions newsletter discusses this increasingly popular alternative to escrows).

How Long Does it Take? – Typical Sale Process Timeline

The following timeline may vary depending on external factors beyond anyone’s control, such as holiday interruptions, management presentation availabilities, etc. However, from our experience, most sale processes take six to nine months to close.

Stay informed

Subscribe to our newsletters to stay on top of industry news, develop your knowledge and receive relevant, real-time advice.