Indications of Interest, Letters of Intent, Sale/Purchase Agreements

Navigating through the sale or purchase of a business for the first time can be a daunting task.

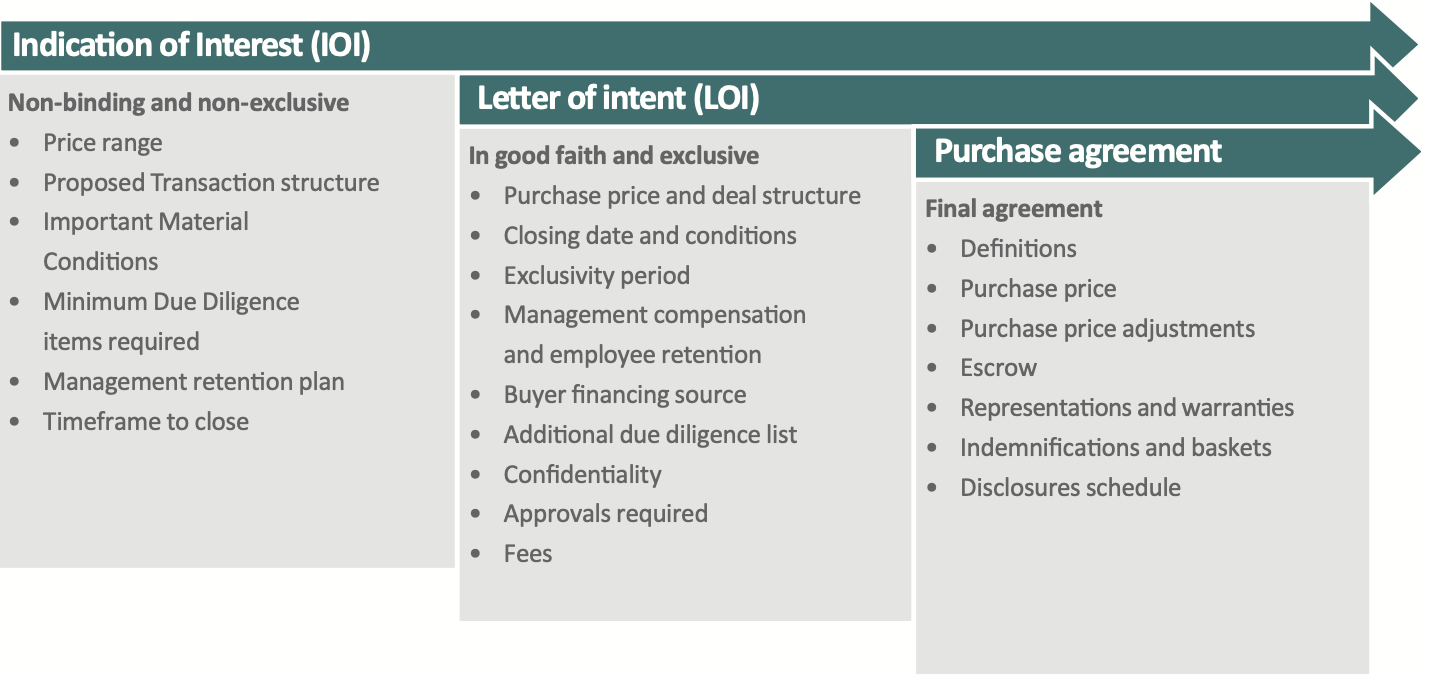

Three Steps Towards a Deal

Typically, the process goes through three steps. First, the prospective buyer produces an Indication of Interest (IOI) which outlines the general terms and conditions for the intended transaction. If the vendor is amenable to the general terms and believes the buyer is credible, then based on further exchanges, the buyer would submit a Letter of Intent (LOI) which can take the form of a firm bid or offer. Finally, in order to seal the transaction, the terms of the LOI would find their way to a formal Sale Purchase Agreement (SPA). In this newsletter, we will outline the differences and the purpose of each of these documents. Here’s an illustration depicting each one in a generic sense.

The Indication of Interest (IOI)

The IOI is typically written before the prospective buyer is given any substantial or confidential information. Its purpose is to define the general scope of the deal in terms of type of transaction (asset or share purchase), price range, payment terms, conditions to be met as part of the transaction and any significant assumptions behind an eventual offer. This will insure both the buyer and the seller understand each other’s mindset concerning the deal conditions. The IOI plays an important part in determining if the buyer will be asked to continue to the next round.

From the buyers’ perspective, the IOI insures that:

- He limits the time and financial resources devoted to the deal if his valuation range or other conditions fail to meet the seller’s expectations or fall short of other offers, and

- It sets forth the key material conditions and the underlying assumptions by which the buyer is prepared to enter into a transaction.

From the seller’s perspective, the IOI allows him:

- to measure the marketplace’s appetite for his company;

- to compare prospective buyers’ views on value; and

- d’effectuer une vérification diligente préliminaire sur les

- to perform a preliminary due diligence on the buyer’s financial resources and ability to complete the transaction.

Importantly, the IOI, which ranges anywhere from two to five pages in length is non-binding to either party except for reciprocal confidentiality.

The Letter of Intent (LOI)

The LOI is a more detailed document which defines the offer with greater precision including the price and the deal structure which will define payment considerations (cash, balance of sale, escrow), closing date and conditions, the required binding exclusivity period, management and employees to be retained and compensation, additional due diligence required, confidentiality and disclosure agreement, fee splitting, etc. The LOI should also give an indication on how the purchase price would be adjusted at closing based on objective criteria such as book value, working capital, included assets profitability, etc.

Although the LOI does not necessarily bind the parties to consummate the deal, and there is language for the buyer to “back away”, there is jurisprudence of damages having been awarded when one of the parties has not acted in good faith.

The Sale Purchase Agreement (SPA)

The Sale Purchase Agreement is the final binding document executed between the buyer and the seller which supersedes any previous IOI and LOI. It is prepared by either the buyer’s or seller’s counsel. In addition to outlining the purchase price it will have a detailed list of definitions used in the agreement, postclosing purchase price adjustment mechanisms and time frames to deliver final statements and adjustment sheets, amount to be put in escrow, representations and warranties, indemnifications and basket clause. Appended to the SPA will be the full set of schedules of the disclosure material and contracts on which the representations and warranties would be claimed upon. This document is obviously binding.

Conclusion

The IOI, LOI and SPA are key documents exchanged at various stages of a sale/ purchase process which incrementally become the backbone of the transaction.

Stay informed

Subscribe to our newsletters to stay on top of industry news, develop your knowledge and receive relevant, real-time advice.