The True Value of Your Business – Normalized EBITDA and Synergies

As a buyer’s notion of value is most often a function of profitability, a seller should

accurately reflect his company’s true profitability and demonstrate the probable synergies a strategic buyer could capture.

As previously discussed in our “What your business is worth?” newsletter, a business is ultimately worth whatever someone else is willing to pay for it. That price is impacted by normalized EBITDA adjustments as well as potential synergies for the buyer.

Normalized EBITDA

Of the several methods available to establish the value of a business, the cash flow generating capability remains the most widely used. The most common, and comparable, measure of cash flow is EBITDA or “Earnings Before Interest, Taxes, Depreciation and Amortization” as it isolates a business’s cash-generating ability before the burdens imposed by capital assets, debt and taxes. This method makes it easier to compare businesses which may have varying levels of debt and capital assets, or may be subject to different taxation levels.

In order to reflect a company’s true cash generating abilities, EBITDA may have to be adjusted or “Normalized” to ensure that only the revenues and the expenses that are directly related to the business are considered. Non-recurring and/or non-core revenues and expenses should be identified to the buyer and added back, or deducted to arrive at a Normalized EBITDA.

Below are some of the most common adjustments found in small to mid-size companies grouped under non-recurring and non-core revenues and expenses:

Examples of non-recurring revenues or expenses:

- Acquisition-related costs

- Business process reengineering costs

- Inventory write-down and write-off

- Gains or losses on asset disposals

- Start-up costs

- Labor, strike-related costs

- Fraud-related costs

- Costs incurred resulting from natural disasters (tornado, flood, etc.)

- Losses/expenses related to discontinued products

- One-time payments made to related parties

- One-time moving and relocation expenses

- Human resources related exceptional expenses (CEO recruitment fees, severance costs, etc.)

Although accounting standards and reporting principles may require that certain revenues or costs be deferred or capitalized, this may not always be the case and an adjustment may be warranted.

Examples of non-core revenues or expenses:

- Remuneration above or below market rates

- Discretionary bonuses, especially if above market

- Personal expenses which might not be directly related to earning company revenue:

- Personal travel & entertainment expenses

- Family and/or personal staff on the payroll

- Life and other insurance premiums, contributions to personal pension scheme

- Vehicles and related expenses (personal use, luxury cars)

- Personal perquisites such as memberships, personal use of event tickets

- Other personal expenses

- Leases or other expenses higher or lower than market (i.e. non-arms-length)

- Fees paid to related parties that cannot be tied to a service provided

- One-time professional fees (set up of family trusts, insurance claims, lawsuits and one-time legal fees)

A simple question to ask when evaluating whether such adjustments are required would be “Were this company to be managed by an independent third party, what expenses would be eliminated and what expenses would have to be added?”

Synergy capture

The rationale behind buying a business operating within the same, or complementary sector is to create a new, combined entity, which is worth more than the sum of the individual parts. This value creation in acquisitions, “synergy”, is defined as the value created by economies of scale and/or the creation of additional revenues resulting from the combination of two businesses. One of the justifications used by strategic buyers (as opposed to financial buyers) in growth acquisitions is to capture these synergies. A financial or non-strategic buyer having no platform to which the addition of new operations would capture synergies may find it challenging to pay a premium. For the seller, this means that his company should command a higher value to a strategic buyer and he should first seek to sell his business to such buyers in order to get a share of the potential synergies and maximize its selling price.

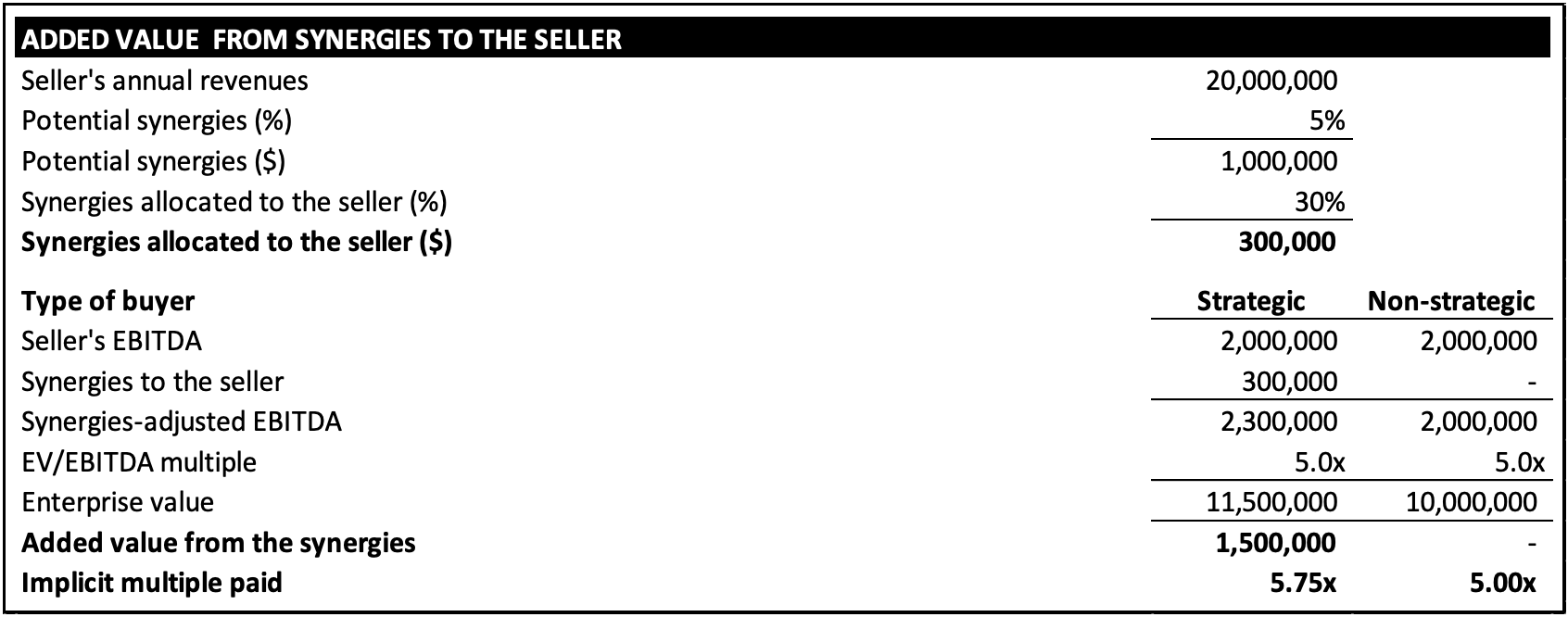

Academic research has shown that, on average, synergies can represent 5% of the seller’s annual revenue and are usually split 70% in favor of the buyer and 30% to the seller. However, one must keep in mind that industry-specific factors will influence, for the better or worse, the synergies created by the acquisition. Below is a practical example of the synergies’ impact on the sale price of a business generating $20M in annual revenues valued on a stand-alone basis at a 5.0x EV/EBITDA multiple.

As shown above, synergies can have a material impact on the sale price of a business. A seller wanting to maximize value should therefore identify potential synergies to the buyer via offering documents such as the Confidential Information Memorandum (“CIM”).

The following is a list of the most frequent items where synergies may be created:

Cost synergies

- Consolidation of back-office functions (administrative, accounting, human resources, etc.)

- Reduction of sales representatives

- Professional fees (accounting, legal, fiscal)

- Marketing expenses

- IT systems maintenance

- Website maintenance

- Tradeshows, memberships and subscriptions

- Supply-side purchase and transport

- Tax benefits

Critical mass synergies

- New revenues from access to new distribution channels

- Cross selling of non-redundant products

- Bundle multiple product/services

- Greater purchasing power resulting in better margin

- Economies of scale

- Multilayered skill sets

In conclusion, to maximize value when selling to a strategic buyer, a seller should clearly outline the synergy-related and EBITDA normalization-related information in his sales and marketing transaction documents to ensure a buyer fully accounts for and understands the potential value creation from the transaction

Stay informed

Subscribe to our newsletters to stay on top of industry news, develop your knowledge and receive relevant, real-time advice.