Benefits of a Vendor Due Diligence (VDD)

Mandating a vendor due diligence prior to launching a sale process can show the company with its best foot forward and initiate the sale process with foresight into the concerns that may be raised by the buyer.

The Letter of Intent (“LOI”) is signed, you have supplied a great deal of information and the buyer has been conducting his due diligence for the last few weeks. Unfortunately, the financial due diligence reveals that your Normalized EBITDA is lower than reported and the buyer is looking to reduce the purchase price by the difference time the purchase multiple as agreed in the LOI. A vendor due diligence may have helped avoid such a dilemma.

Situations like this are not uncommon. Between the signing of the LOI and the closing of the transaction, due diligence can reveal both pleasant and unpleasant surprises for the buyer and the seller. While positive findings are usually not revealed to the seller, negative findings are generally always revealed and can be used as leverage to ratchet down the purchase price or affect other key items such as the Working Capital Target, Indemnity Escrow Amount, Indemnity Cap, etc.

Mandating a vendor due diligence prior to launching a sale process can show the company with its best foot forward and initiate the sale process with foresight into the concerns that may be raised by the buyer.

Conventional Due Diligence

A due diligence review is normally mandated by prospective buyers in order to understand the assets being acquired, as well as to discover any inherent financial, legal, fiscal and environmental liabilities. A good due diligence strengthens a buyer’s resolve by lessening post-acquisition surprises. Consequently, the results of a due diligence may cause a buyer to:

- Require additional provisions in the purchase agreement with respect to the seller’s standard indemnities and guarantees;

- Negotiate an adjustment to the selling price; or

- Require a commitment by the seller to correct any observed deficiencies.

Unfortunately, these problems frequently only surface relatively late in the sales process once the seller is emotionally engaged.

For vendors, conducting their own vendor due diligence (“VDD”) can avoid the above by revealing unpleasant surprises that would otherwise have been uncovered during the sales process and which could negatively impact the value they expected to obtain from the sale,

We have noticed that the trend is for vendors to carry out their own due diligence well before beginning the sales process.

What is a vendor due diligence?

Whereas a buyer’s due diligence typically includes legal, financial, fiscal, environmental and other assessments, a VDD typically focuses on the financial history and forecasts as represented in the sales offering document (“CIM”). The report, commonly called a Quality of Earnings report is prepared by an accounting firm. (In some cases, when in doubt, the vendor may also mandate other reviews).

The Quality of Earnings report establishes the company’s historical, standardized EBITDA and includes an average, normalized working capital analysis. The report will reassure prospective buyers as to the veracity of the financial results presented and potentially reduce the scope of a buyer’s own due diligence requirements. It may also enhance the buyer’s ability to obtain financing for the transaction.

In order to ensure there are no conflicts of interest, it is advisable that the VDD mandate will be given to professionals who do not already work for the company either as their auditors or financial advisors. Although the VDD report will be without recourse to the firm who prepares it, it will nevertheless be prepared with a duty of care and diligence by reputable professionals. A good VDD report will anticipate buyers’ questions and will look to provide satisfactory answers and explanations to prospective buyers during the sale process.

Examples of areas addressed by a Quality of Earning include, but are not limited to:

- Normalization of owner/shareholders’ salaries and other benefits

- Inventory provisions

- Normalizing the impact of the exchange rate

- Normalization of non-recurring expenses

- Analysis of operational working capital over the past 12 months

- Analysis of a dependence on key customers and suppliers

(As required, other items may include: bad debts, normalized market rents, validation and reconciliation of accounting treatments related to specific industries such as product guarantees, exceptional supplier credits, etc.)

What are the advantages for the seller of proceeding with his own VDD?

As a detailed review prior to showing the business to prospective buyers, the VDD gives a seller the opportunity to understand and address any anomalies that have been raised well before the company is brought to market.

The VDD will allow all parties to use a single set of financial data to confirm the ‘quality’ of earnings and provides a solid basis for evaluating and preparing financial projections where appropriate. The stronger the starting base, the lower the likelihood of a renegotiation of purchase price or other conditions occurring between the signing of the letter of intent and the closing of the transaction.

Preparing a VDD ahead of the transaction will also allow the seller’s management team to be preparedand will reduce conflicts and the stress associated to the buyer’s due diligence inquiries.

The VDD is typically prepared in a format adapted to the context of the transaction such that the financial and operational information can be easily manipulated by the buyer. The report will typically include a “datapack”’ or “factbook” which can reconcile the financial statements to the quality of earnings report.

Good for the seller – Good for the buyer

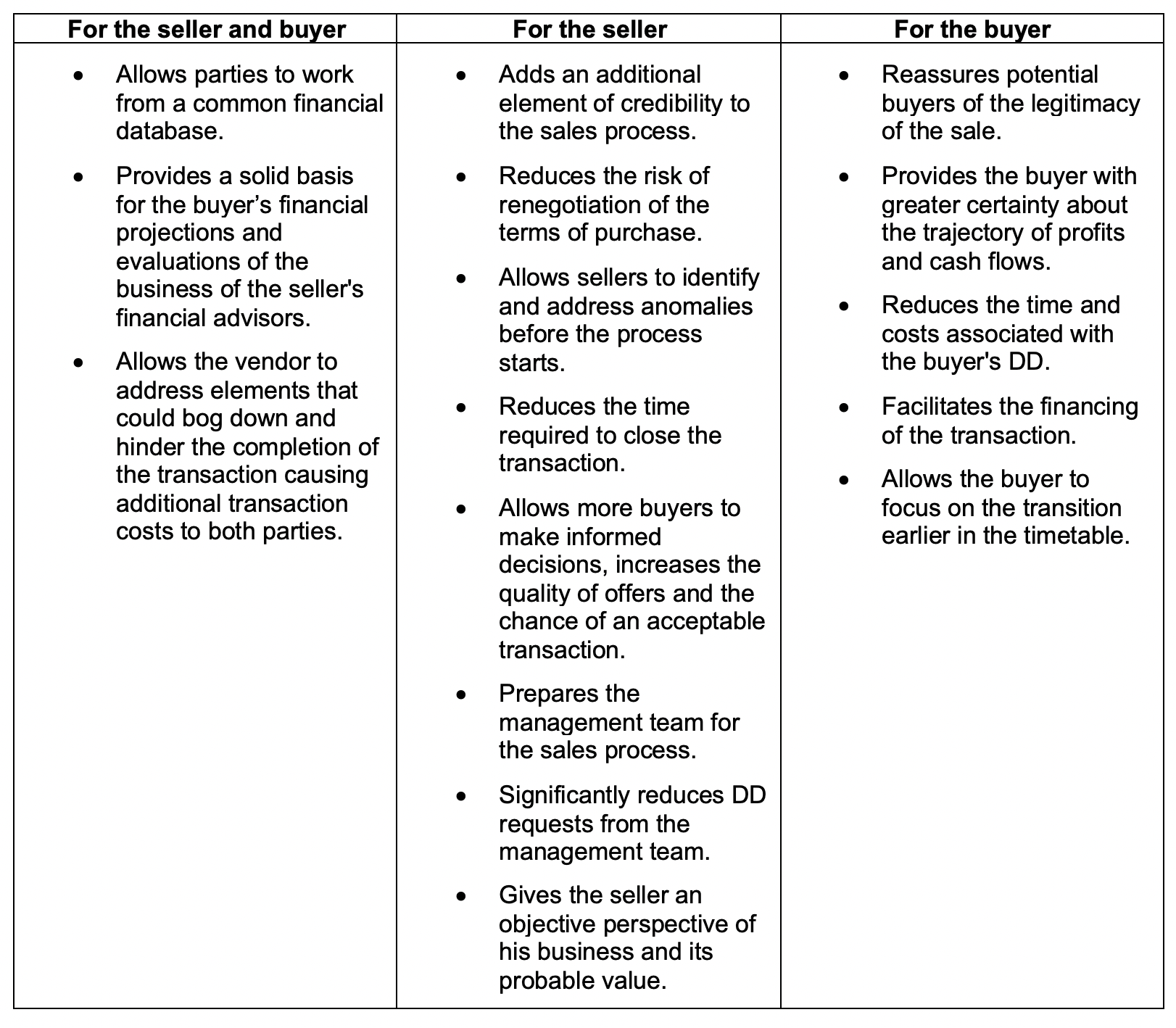

In summary, the benefits to the parties are:

When to start the VDD

It is best to start the VDD well before taking the company to market in order to be able to identify problems and correct them. Despite incurring additional costs, our experience tends to show that these will ultimately be fully compensated by a more rapid transaction, under the best possible conditions with increased credibility in the marketplace.

Given our M&A transactional experience, we can guide you in selecting the right firm to prepare your VDD report.

Stay informed

Subscribe to our newsletters to stay on top of industry news, develop your knowledge and receive relevant, real-time advice.