Representations and Warranties Insurance in M&A Transactions

In an M&A transaction, the vendor must typically indemnify the buyer (subject to certain limits and exclusions) for any violations of the representations and warranties made in the sale transaction. The representations typically include statements related to, among other things, the accuracy of the financial records, assets, liabilities, and environmental issues. The vendor will also warrant that he has the capacity to execute the transaction (i.e. that he owns the shares, that they are unencumbered and that no other person has a say over the transaction).

Representation and Warranties Insurance is an insurance policy which provides a purchaser with coverage should he suffer losses due to a violation of the vendor’s representations and warranties. This coverage transfers the risk for any claims from the vendor to the insurer.

Indemnities can be guaranteed by placing 10% to 15% of the sale price in escrow, or, if the vendor finances part of the sale, the parties may agree use the balance of sale to settle any warranty claims. In either case, the indemnity period is usually from one to three years which should be sufficient to allow for any issues to arise. Unfortunately, both mechanisms have shortcomings which ultimately result in at least one party not being fully satisfied.

Representation and Warranties Insurance as an Alternative

After increasingly widespread use in M&A transactions by private equity funds in the United States, Representations and Warranties insurance, or “Reps and Warranties Insurance”, has begun gaining ground in Canada and Europe.

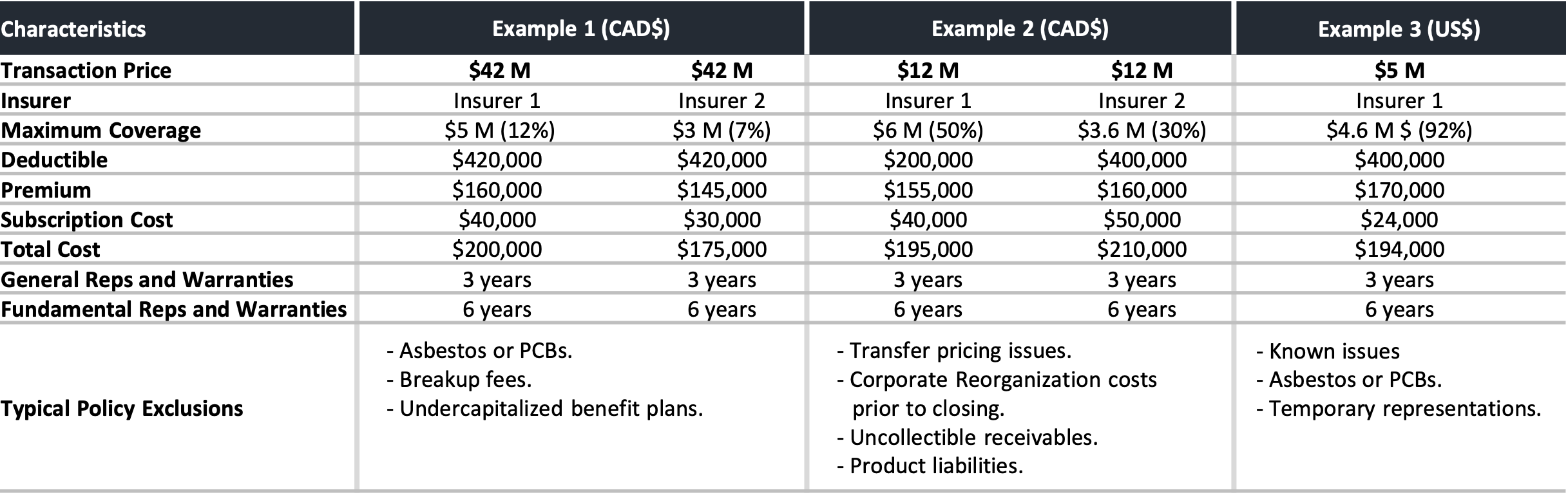

In Canada, these policies are underwritten by several different insurers such as AIG and Chubb and are sold through brokers. The following table, from three of our recent transactions, illustrates the principal characteristics commonly found in this type of coverage:

Subscribing to Reps and Warranty Coverage

As a first step, an insurer will be requested to issue an offer of coverage. The offer will be based on a review of the transaction documentation such as the purchase agreement, the representations and warranties made by the vendor, the acquirer’s due diligence reports and certain other data room documentation.

Next, a subscription fee ranging from $30,000 to $40,000 will be paid, whereupon the insurer will carry out a due diligence review resulting in a coverage proposal which will note all inclusions and exclusions. Thereafter, the insurer will issue the policy once the premium is paid.

Who pays for the policy will be subject to negotiation between the buyer and vendor; sometimes it is the vendor, or the acquirer and sometimes it is shared by both. Good practice suggests agreeing on the fee split in the LOI.

Advantages of Reps and Warranties Insurance:

Use of this type of insurance has been on the rise due to the benefits for both the acquirer and vendor.

For the acquirer:

- Offers superior protection to what the vendor may otherwise be ready to offer

- Provides a longer period of coverage than what would normally be obtained from a vendor

- Offers a more attractive offer to put forth to the vendor as there are no amounts to be held in escrow or potentially withheld from a balance of sale

- Promotes smoother sale-purchase negotiations

For the vendor:

- Simplifies the transaction and reduces uncertainties

- No funds withheld from sales proceeds nor uncertainty regarding balance of sale

Reps and Warranties Insurance coverage will be of particular interest to a vendor who retains some ownership after the sale transaction and avoids contentious discussions between the parties.

Limits to Reps and Warranties Coverage

Despite the advantages, this type of insurance does have limits. Almost all policies contain exclusions and none will cover the full value of the transaction. The risk of incurring an extraordinary loss can remain.

The coverage will not extend to a vendor’s violation of engagements in the sale agreement nor will it cover purchase price adjustments (i.e. adjustments for working capital). Other exclusions will usually include environmental liabilities and certain tax related liabilities such as R&D tax credits or tax losses.

Based on our experience, even with the above-mentioned limits, Reps and Warranty coverage greatly streamlines the work and negotiations surrounding a transaction and increases satisfaction on both sides. Transferring a portion of the post transaction risk to a third party relieves a degree of stress.

Cafa can help you evaluate Reps and Warranty coverage for your next transaction as well as help negotiate its adoption with your acquirer (or vendor).

Stay informed

Subscribe to our newsletters to stay on top of industry news, develop your knowledge and receive relevant, real-time advice.