Private Equity Funds – Seven Simple Answers

Private Equity Funds - what are they? In this newsletter, we review what PE Funds are, how they work, how they get funded, how big is the industry, how they get compensated and what are they looking for.

Private Equity Funds have become the “go-to” buyers for entrepreneurs seeking to monetize the equity in their businesses. Also called “PE Funds” or simply “PEs”, they are a dominant force in the financial industry today and many entrepreneurs have yet to understand how they can benefit from this development.

- What is a PE Fund?

A Private Equity is an investment pool in the form of a fund that makes investments in companies, supports their growth, and then sells them to provide liquidity to their investors. Although PE Funds exist in several types of alternative investments (to traditional investment approaches), such as infrastructure, venture capital, real estate, private debt and others, this newsletter will mainly address Buyouts and/or Growth Equity PE Funds.

- How does a PE Fund work?

A PE Fund employs experienced professionals possessing sophisticated operational and financial capabilities. These individuals typically come from the financial sector or have a successful entrepreneurial background, having owned or operated businesses in the past. Leveraging this expertise, the fund pro-actively seek to identify underperforming assets or market consolidation plays to generate investment opportunities that will translate into higher returns than what other asset classes would produce, such as public equities, fixed income, etc.

A typical PE Fund will have a 10-year lifespan, following which there is a planned return of the invested capital to their investors (usually called Limited Partners or LPs). Hence, given the time required to invest and de-invest within a PE Fund’s lifespan, the effective performing holding period for a portfolio company is usually between 4 to 7 years.

Following the initial investment, PE Funds strive to increase the value of the portfolio company by increasing its EBITDA (earnings before interest, taxes, depreciation, and amortization) and increasing the exit valuation multiple by the time the portfolio company is sold. This value appreciation is accomplished through the following means:

a) Growth: The most important value creation factor for Private Equity Funds is EBITDA growth. This growth is achieved by implementing operational efficiencies, pursuing organic initiatives (internal projects), and undertaking inorganic expansion (acquisitions).

b) Leverage: PE Funds use financial leverage (i.e. debt) to improve returns on their investments.

c) EBITDA Multiple Expansion: Expansion is also achieved through higher EBITDA margin and by diversification (reducing customer concentration, minimizing the risk of supplier dependency and increasing geographical diversification) and/or established revenues (improving product and revenue diversification, and increasing the recurring revenue base).

When acquiring a company, the PE Fund will often require the seller and/or management team to reinvest or “roll” part of the sale proceeds in the company’s equity going forward.

- How does a PE get funded?

A PE Fund receives its funds from Limited Partners (“LP”) which are usually institutional investors such as pension funds, insurance companies, sovereign funds or high net worth investors looking to diversify their investment portfolios. These individuals have a passive role in the fund management and investments.

- How big is the industry?

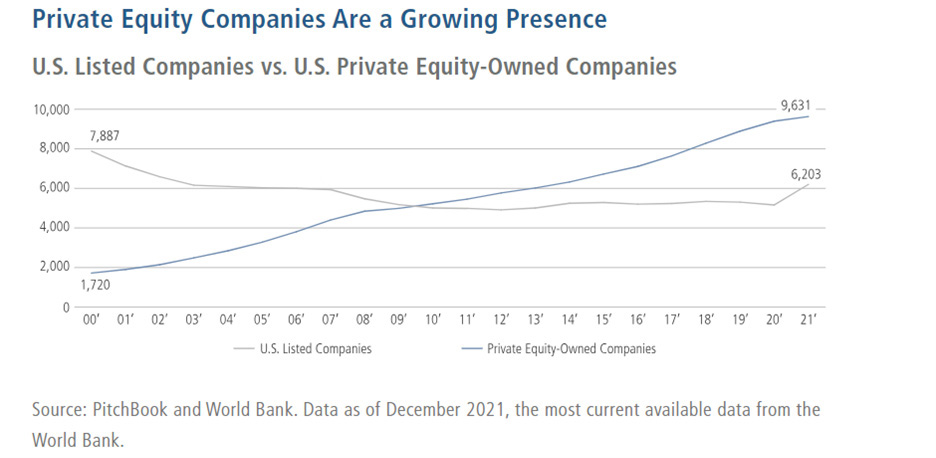

For over two decades, PE Funds have been replacing the public markets as exits for shareholders. Between 2000 and 2021, the number of U.S. PE-backed Companies has surged from around 2,000 to nearly 10,000. In contrast, the number of Public Companies has fallen from 8,000 to 6,000 during the same period.

It is estimated that the alternative investment assets under management (AUM) will grow from $1 trillion to $23 trillion by 2027 supported by the attractive returns, larger allocations by non-institutional investors such as High Net Worth and family offices, and new distribution channels.

- How does the fund get compensated?

A PE Fund receives compensation through periodic management fees, typically set at 2% of the fund’s committed capital, and through a carried interest, typically 20% of the returns above a minimum return threshold.

- What is a PE looking for in a company?

A PE Fund employs various quantitative and qualitative criteria when evaluating companies; ypical requirements include:

Quantitative Criteria:

- Usually a minimum EBITDA of $5M for U.S. funds and $2-3M for smaller regional funds;

- Management team participation of 10-30% in post-trade equity;

- Limited maintenance capital expenditures (low capex);

- Easily identifiable cost reductions;

- Leverage-friendly industries.

Qualitative Criteria:

- Large markets in which the investment companies operate;

- Presence in a growing industry or sector;

- Differentiation vis-à-vis the competition;

- Competent management team committed to business growth;

- High barriers to entry;

- Presence of captive customers;

- Industries in which the fund possesses experience;

- Fragmented industries, with numerous “Add-on” opportunities;

- Identifiable exit strategy i.e. who will be the next buyer.

- Do you qualify?

If your company meets any or most of these criteria, then a Private Equity Fund might be the right buyer for your company. Depending on your objectives, you will present your company either as a platform – by demonstrating that your company has an achievable growth plan, through acquisitions and organic growth, or as an add-on – by demonstrating that your company can easily integrate into and bring value to a larger group.

However, before initiating a sale process, we recommend you undertake the following preparations:

a) Conducting vendor due diligence reports: Typical vendor due diligence reports include a “Quality of Earnings” to validate historical profitability, as well as legal and environmental evaluations, prepared by qualified professionals. These reports help avoid unpleasant buyer due diligence surprises and reduce the likelihood of the buyer decreasing their offer price after an LOI is signed. By providing all the information needed for the buyer’s due diligence at the outset, you can significantly reduce stress during the process. Please refer to our newsletter Benefits of a Vendor Due Diligence (VDD) for more information.

b) Keeping your interim and management reports up to date: To prevent renegotiation of purchase terms, it is important to make realistic projections that can be reasonably achieved and surpassed. PE firms will also request monthly results during the process and closely monitor your EBITDA on a 12-month trailing basis to ensure consistency with their valuation. Additionally, they will require regular updates on your Key Performance Indicators (KPIs).

c) Preparing for sale: It is advisable to resolve any issues that may slow down or taint the sale process, or become post-transaction claims. This may include resolving structural repairs as a property owner, settling all disputes, undertaking environmental clean-up, renewing collective agreements, and renegotiating major contracts. Additional information for this topic, and the one above, can be found in our newsletter Preparing Your Business for Sale.

Cafa has sold many companies to Private Equity funds either as a platform investments or add-ons. Please do not hesitate to reach out to us to see if your business can qualify and for a preliminary list of buyers.

Stay informed

Subscribe to our newsletters to stay on top of industry news, develop your knowledge and receive relevant, real-time advice.