Different Strategies for Selling Your Company Under Different Situations

There exist different strategies for selling your company. This newsletter examines three distinct ways of putting your company up for sale.

As a business owner, you most likely regularly receive phone calls, emails and letters from companies either wanting to acquire your business or offering to sell it for you claiming they have a buyer. Whether or not you are currently an interested seller, you should be aware of the different strategies for selling your company.

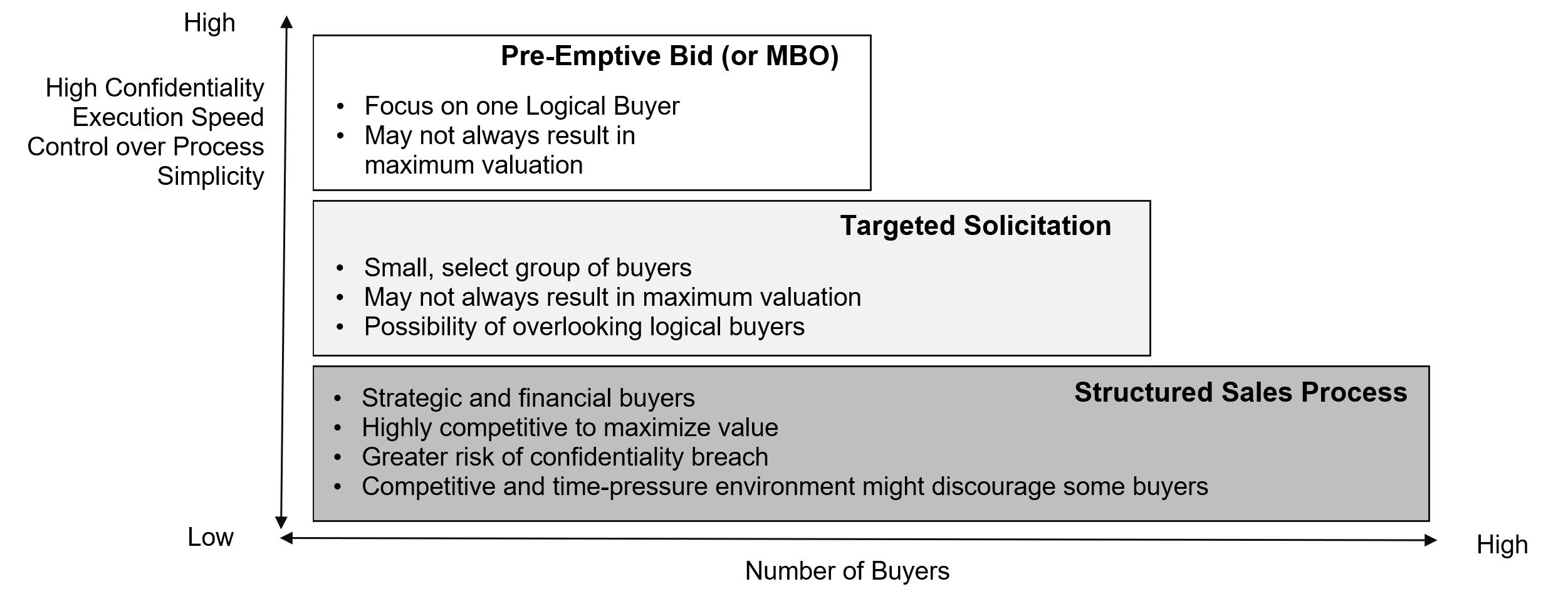

M&A advisors can offer various exit strategies, but it is ultimately up to you, the seller, to decide which course of action best suits your needs and, most importantly, your tolerance for risk and your patience. For some, execution speed might be the most important factor, for others it would be maximizing the price, finding the right buyer and finally some might prioritize confidentiality.

This newsletter lays out three different strategies for selling a company that an investment banker should present to a client as they decide together what is best for their unique situation. The following chart summarizes the basic differences among the three:

A. Pre-emptive Bid

A pre-emptive bid typically occurs under two circumstances.

- A buyer, strategic or financial, reaches out directly to a target to inquire about the prospect of buying and the seller agrees to entertain discussions instead of soliciting multiple buyers, or

- A seller prepares itself for a competitive process but grants a “first look” to the most likely buyer before engaging with other potentially interested parties at large.

Most commonly, the buyer is well informed as to the nature of the business and may require less due diligence work, especially if it is a strategic player already present in the sector. The obvious advantage of this exit avenue is that the divestiture process is quicker (3-5 months) as only one buyer is involved. This avoids the preliminaries of identifying and courting multiple buyers and fielding questions and meetings before obtaining expressions of interest. This strategy can also prevent competitors, customers, suppliers, employees and others from finding out you are for sale as the activity is limited to only one party.

In terms of valuation, a pre-emptive bid can be a double-edged sword. The pre-emptive bidder might offer a generous price to avoid having the seller test the waters with other prospective bidders. The potential is high if the target is highly attractive and is likely to gain traction with multiple suitors. However, the opposite is also true; the pre-emptive bidder might offer a lower price knowing it faces little competition from other buyers.

Prior to divulging information to the buyer, we recommend preparing the marketing materials as if the company was going fully to market. This would include producing a buyers list, teaser, NDA, CIM, financial data pack and management presentation. The pre-emptive bidder is informed at the very start of the process that it must deliver an Expression of Interest (or Letter of Intent) by a set deadline failing which a structured sales process will be launched. We favour this approach for four main reasons:

- It forces the pre-emptive buyer to act quickly in making an offer lest he loses his exclusivity to competing buyers.

- It will show the pre-emptive buyer that the seller is ready to approach other buyers if its offer is unsatisfactory.

- The company is professionally presented in its best light and with critical information for the pre-emptive bidder to fully understand the risk and underlying value.

- After considering the CIM and financial data pack, if the buyer ultimately decides not to submit a bid or submits a wholly unsatisfactory bid, the exit strategy can quickly be switched to a targeted solicitation or managed auction if desired by the seller.

Offering a Management Buyout to your management and employees can be considered a type of pre-emptive bid. Many of the benefits are similar, potentially faster execution, far less due diligence, and preventing competitors, customers, suppliers, and others from finding out you’re for sale. Again, if the MBO attempt fails, you can revert to alternate sale strategies.

Note, however, that MBOs don’t come with their own challenges; please read our two newsletters “MBO – Management Buyout – Key Takeaways”, and “Key Elements for a Successful Management Buyout (MBO)” both of which examine MBOs in greater detail.

B. Targeted Solicitation

The second strategy for selling your company lies halfway between the intimacy of a pre-emptive bid and the full-fledged auction process lies the Targeted Solicitation approach. The M&A advisor works with the client to target a small group of two to five parties most likely to be interested in the business and having the wherewithal to pay for the acquisition. Typically, sizeable strategic players and/or sector-expert financial buyers (with or without an existing platform in the space) are invited, thus ignoring “generalist” parties and any strategic players who may not have the financial capacity to transact. Like the pre-emptive bid, this approach allows for a quicker and smoother due diligence as the selected buyers are presumably already well versed in the industry. This approach may, however, result in the client having to divulge sensitive information to competitors as they are usually among the potential suitors.

The Targeted Solicitation approach provides for greater competitiveness than the pre-emptive bid and can result in a bidding war. In some cases, strategic buyers can, for example, be enticed to allocate some of the synergies to the seller in order to win the bid.

Some sellers are hesitant to take the Targeted Solicitation route as it often involves talking to a direct competitor or close stakeholder, despite providing greater certainty of a high valuation while keeping the process relatively short (4-6 months). To alleviate those risks, a well-advised seller should make it clear to all bidders that sensitive information will only be disclosed towards the end of the process, thus ensuring that only the winning bidder gets to learn about customers, suppliers, employees and other critical information.

Another advantage of a Targeted Solicitation, and an area where Cafa has had success, is with “geographic targeting”. When the seller is too concerned about his clients, suppliers and competitors finding out about an impending sale, Cafa will target buyers in a different geographic market. With partners covering Western Europe, the U.K. and Asia, Cafa can reach buyers well beyond a client’s backyard. Our newsletter “Selling Your Business – The European Advantage” delves into this opportunity more closely.

C. Structured Sales Process

A managed auction aims to create a competitive environment among bidders, in order to try to get the highest valuation. To achieve this, M&A advisors manage a tight process that keeps all bidders under strict deadlines, otherwise the deal can take too long to reach the offer stage and momentum fades. All buyer types are approached, the strategic buyer, the sector-expect financial buyer and the generalist financial buyer, thus increasing the competitive landscape and the chance of hitting a “home run”.

Much more structured than the pre-emptive bid and Targeted Solicitation approaches, the Managed Auction’s main objective is to bring as many potential buyers as possible to the table under strict predetermined timelines and bid formats. Bidders not complying with the process requirements are eliminated from the process. The seller can also expect to receive an increased volume of questions and preliminary due diligence than in a pre-emptive bid or Targeted Solicitation setting especially from generalist buyers.

The Managed Auction is the most time consuming and lengthy (5-7 months) of the three strategies given its additional steps and the increased volume of questions & information request from approaching numerous parties.

While bringing a larger number of potential suitors (100+) may, in theory, amount to a greater number of offers, the seller should understand that some highly strategic buyers could decide not to pursue the deal because they are not comfortable participating in a bidding war.

As outlined in this newsletter, there is more than one way to go about selling a business and an M&A advisor should work with the client to determine the best course of action depending on the seller’s unique circumstances. Please engage with one of our partners to further discuss the pros/cons of each strategy.

Stay informed

Subscribe to our newsletters to stay on top of industry news, develop your knowledge and receive relevant, real-time advice.