Buying an insolvent company… there is a way

Buying or selling a financially distressed company often looks like an improbable, if not impossible task, especially in the context of preserving the customers, suppliers, key employees and salvaging some minimum value for the former owners. Can a purchaser’s needs meet a vendor’s expectations? Here is an illustration of how to achieve a transaction in this context.

The Situation

Our client was recently approached to purchase an important competitor. This purchase would allow our client to increase his market share while rationalizing an industry suffering from overcapacity. The competitor, however, was experiencing serious financial difficulties. Nevertheless our client saw value in making an offer that would allow the vendor to continue operating successfully through an integration period. Our client also wished to minimize the vendor shareholders’ losses as the individuals would prove valuable to the combined operations.

The target company’s profile was as follows:

- The company operated two plants; one in Quebec and one in Ontario; one of the properties was separately owned by the shareholders and leased to the company, while the other was leased from a third party;

- Annual sales were $50M with more than 40% to the US;

- Historically the target generated $2.5M of EBITDA* per year, however with the strengthening of the Canadian Dollar in 2007, EBITDA fell to $850,000 per year;

- Total interest-bearing debt stood at $7.2 millionAu moment de l’analyse, le bilan de la compagnie ciblée était le suivant :

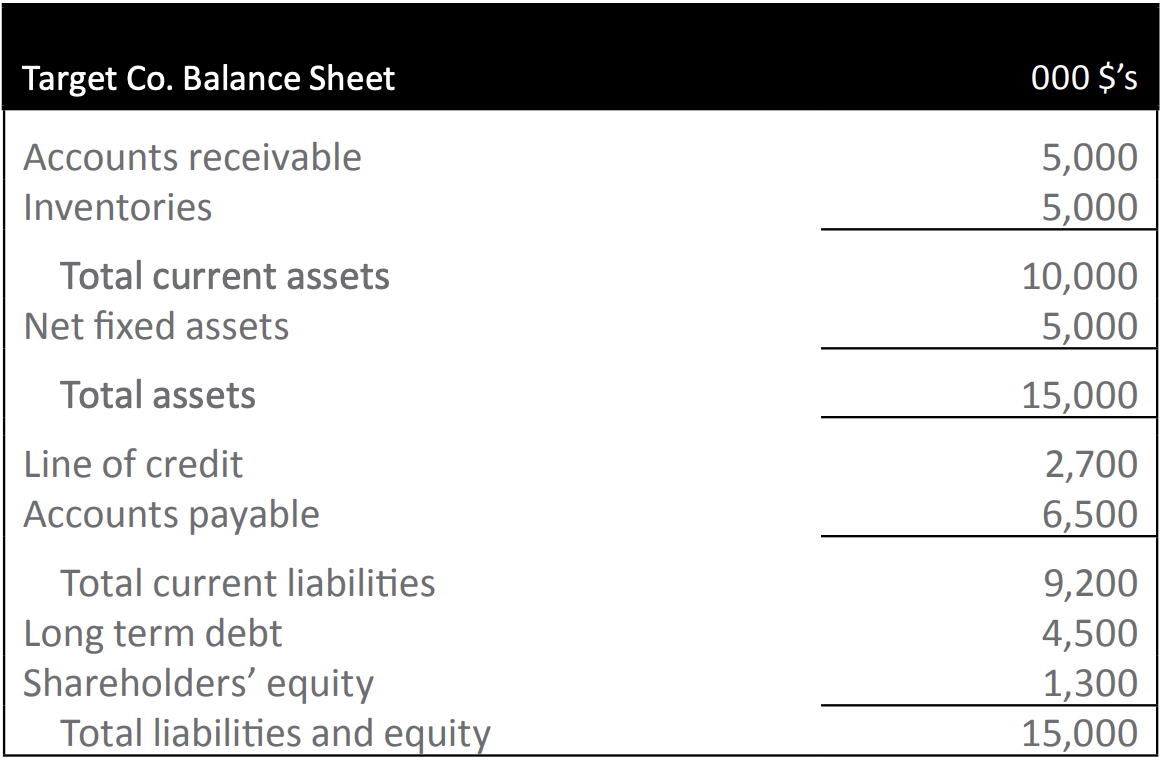

The target company’s balance sheet at the time was as follows:

Before the appreciation of the Canadian dollar, the interest-bearing debt represented less than 3 times EBITDA, which, although high, was not an overly aggressive leverage in normal conditions. With dollar parity however, the company’s loans were now in excess of 8 times EBITDA. This presented two major problems:

- From a practical standpoint, a prolonged drop in cash generation meant an inability to service the debt, and

- From a contractual point of view, the target was in default vis-à-vis its lender with respect to financial covenants such as the maximum senior debt to EBITDA.

The target company’s shareholders considered numerous scenarios before putting the company up for sale, however most were ultimately too costly to be practical.

The Alternative – the CCAA

Despite the situation, our client was determined to find a solution and proceeded with the potential acquisition analysis including a preliminary due diligence.

It became evident that given the debt level, no one could justify putting up enough cash to satisfy all of the creditors and continue the operations. A restructuring approach appeared to be the only obvious alternative. Cafa suggested the use of the provisions available under the Companies’ Creditors Arrangement Act (CCAA) to purchase the current assets, fixed assets and order book in order to gain the support of all stakeholders.

Cafa negotiated an asset purchase under a prearranged “bought deal” to be done subsequent to a filing under the CCAA. The offer was negotiated conditional on the court’s approval of the sale but not conditional upon the acceptance by the creditors of the CCAA restructuring plan.

Cafa recommended purchasing the trade receivables and inventories at a discount, and the fixed assets and order book for the balance outstanding under the existing long term debt. This structure generated sufficient cash surplus to cover transaction costs, the cost of closing one of the two manufacturing facilities and left just enough cash to the unsecured creditors for the company to continue its operations.

Having purchased the receivables and inventories for less than face value, and seeing as how the company continued to operate, our client was able to realize a gain on their realization. This cash was used to finance integration costs and some minor improvements.

For their part, the selling shareholders were released from their personal guarantees and were thus able to keep their real estate with a new long term lease; they were also offered a long term employment agreement.

Conclusion: Is everyone satisfied?

There are several benefits for a buyer to pursue this method:

- The assets are conveyed free and clear of virtually all adverse claims other than assumed claims.

- The buyer is practically assured of being the only buyer because of the lead time he will have had in conducting his due diligence.

- The buyer is able to preserve the business’ integrity while being able to terminate money losing contracts, onerous supply agreements, leases, etc. without recourse.

From the shareholders’ point of view, although their investment is lost:

- The principals have avoided being called on their personal guarantees and prevented a serious deterioration of net worth;

- The principals secure a new long term tenant for their real estate asset;

- The principals have an opportunity to continued employment as management with an incentive,

- The principals’ credit and reputations can emerge relatively unscathed.

From the creditors’ point of view:

- Secured creditors are made whole,

- Unsecured creditors unfortunately do burden a certain loss, however it is less than the loss had the company shut down and/or gone bankrupt (i.e. they now have a more viable customer).

*EBITDA: Earnngs before interest, taxes, depreciation and amortization.

Stay informed

Subscribe to our newsletters to stay on top of industry news, develop your knowledge and receive relevant, real-time advice.