EBITDA or Rental Income – Impact On Enterprise Value

EBITDA or Rental Income — What Is Your Choice?

Owning real estate in an operating company or leasing it from an affiliate can have a significant impact on enterprise value and the net disposal proceeds to vendors in an M&A process.

This newsletter outlines how different M&A participants view real estate and shows how sellers can unlock hidden value from their real estate assets in the sale of their business. We also show how buyers can benefit from unbundling the real estate value after an acquisition. This topic and examples only apply when the ultimate owner of a company is also the ultimate owner of the real estate (directly or through a separate real estate holding company).

For illustrative purposes, we will use a fictitious industrial or distribution company that generates $2,000,000 in EBITDA and is being valued at a 7 times EBITDA multiple. Let us also assume that it occupies 20,000 sq. ft. of industrial or warehouse space. We’ll assume that all occupancy costs are paid by the operating company, so the lease calls for triple-net rental rate and the market capitalization rate is 5% for industrial real estate (see below for definition of capitalization rate).

If the building is owned by the operating company, there will obviously be no leasing expense. On the other hand, if the real estate is leased from a parent or sister company, the financial statements will include rental payments to a related party. First let’s deal with the adjusted EBITDA in the case of a building leased from an affiliate.

Adjusted EBITDA Depending on Being a Seller or a Buyer

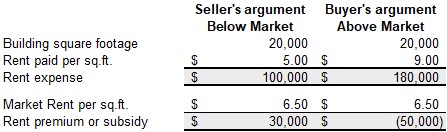

Based on experience, we have seen many sellers’ advisors adjusting EBITDA to reflect below market rent in presenting historical EBITDA to the buyers. Similarly, we have seen the buyer’s due diligence advisor adjusting the EBITDA for above-market rent. The argument is as such: our client is currently paying $5.00 per sq. ft. to his holding while the market rate is currently $6.50 per sq. ft. for an equivalent property – or – your client is paying himself $9.00 per sq. ft. while the market is $6.50 per sq. ft. The adjustments to EBITDA would be as follows:

Impact on Valuation

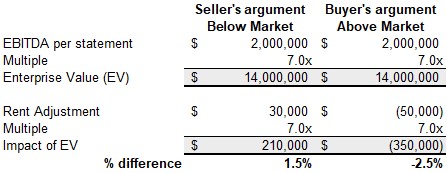

As illustrated above, although the impact on the restated EBITDA to account for the difference between rental rate paid vs. market rent may be small, the valuation multiple used amplifies the rent adjustment as shown below.

Although the adjustment may not be considered very material, it would nonetheless help pay for a good portion of the sellers’ or buyers’ transaction costs.

Real Estate Valuation

Real estate appraisers typically use multiple methods to determine a property’s fair market value. These include replacement cost, comparable transactions and income stream approach. Leaving aside the first two methods for the moment, the income stream approach applies a capitalization rate, or cap rate, to the property’s net operating income to determine its value.

In this current low interest rate environment, we have seen a downward trend in the capitalization rates used for real estate transactions.

In simple terms, capitalization rates can be viewed as the inverse of the EBITDA multiple. A cap rate of 8% translates into a 12.5 multiple (1/.08%) while a 5% cap rate would be equivalent to a 20 multiple. One can quickly realize that there is an arbitrage opportunity when the multiple used to determine the enterprise value and the underlying real estate is lower than the real estate market multiple (i.e., the capitalization rate).

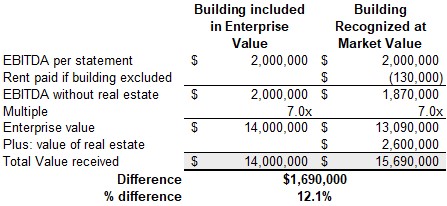

Going back to our previous example and using a capitalization rate of 5%, the value of the property on a stand-alone basis with a long-term lease from the operating company would be $2.6 million to a real estate owner.

Impact of Unbundling the Real Estate

If the property was sold by the owners as part of the transaction at the same multiple as the enterprise value, the owners would be leaving a considerable amount of money on the table by ignoring the underlying value of the real estate. The following table shows how a seller could get more for both assets in separating them and selling them to two different buyers.

From the Buyer’s Perspective

From the buyer’s perspective, unbundling the real estate from the operating company’s balance sheet can yield more leverage and cheaper financing with a longer amortization. Firstly, the lender’s profile is different for these two assets i.e., the operating company’s cashflow and the real estate income stream. Real estate lenders tend to prefer long-term amortizations with fixed rates while operating lenders tend to have shorter amortization periods. Because real estate lenders also lend on a steady-stream income, they tend to lend more than commercial banks on an operating company’s cashflow.

Another important consideration for the buyer is that if the transaction is a share purchase all of the included assets inherit the existing company’s historical undepreciated capital cost (for tax purposes). Buying the property separately, as an asset purchase allows for the higher cost base for tax depreciation going forward.

Conclusion

Holding real estate, directly or indirectly, by the operating company can have a significant impact on enterprise value and the net proceeds to a seller or a buyer’s cost. Obviously, there are many other considerations to consider such as:

- the quality of the underlying property;

- the potential for expansion or development;

- the desire of the sellers to continue receiving rental income going forward vs. cashing all at once;

- the tax implications of a real estate sale;

- the strength of the tenant going forward;

- the ability to leverage the lease after the sale;

- the duration of the lease.

Cafa has been party to several transactions where the seller and the buyer have been able to unbundle the underlying asset value. We would be pleased to have a discussion to outline your options.

For additional material on buying and selling companies, please feel free to see our other Newsletters and Tools.

Stay informed

Subscribe to our newsletters to stay on top of industry news, develop your knowledge and receive relevant, real-time advice.