Credit Evaluations …why you didn’t score

When is the last time you’ve failed to score? Could it be the last time you asked your banker for credit?

We are all aware of credit ratings for investment vehicles, commercial paper and the like; however were you aware that you and your company are also rated? Your suppliers and credit agencies regularly compile your payment habits; your lenders evaluate your risk worthiness. Just how much impact does this have on your ability to borrow?

A little background

The use of sophisticated expert systems (“credit scoring”) to evaluate a borrower’s risk profile is nothing new. In the early 70’s computer software was already being used to evaluate consumer credit. By the ‘90’s these analytical database systems migrated to corporate risk and credit analysis geared towards corporate lending.

In parallel, for the past several decades rating agencies have been evaluating the financial risk of large corporations and government entities using relatively similar methods.

The growing complexity of markets and financial products has recently given rise to the use of predictive systems. These systems rely on complex mathematical formulas which attempt to predict and evaluate the impact of changes in the financial environment.

What is Credit Scoring?

In lay terms, credit scoring is a computer-based financial toolkit which automatically calculates a person’s, or company’s solvency and the probability that they will eventually be able to repay a loan. This used to be the job of the bank manager or an account manager, however with growth and globalization banks could no longer rely on the subjective analysis of one individual. As lenders sought to better control risk they adopted more and more sophisticated systems which not only evaluate any given individual’s or company’s risk profile, but can instantaneously evaluate their entire loan portfolio’s global risk profile in real time. Development of such systems was also strongly encouraged by regulatory authorities.

For less important loans, banks will generally rely on the strength of personal guarantees. Risk analysis and lending decisions will be based on the guarantor’s personal credit rating.

For more important loans, computer based models will use factual data (financial statements, payment history) as well as generic data (economic perspective and industry outlooks). This typically generates an initial score which will then be adjusted against empirical data (quality of collateral, management’s experience). The final score could likely be manipulated by the underwriter’s emotional experience which is largely impacted by the memory of past deals gone bad.

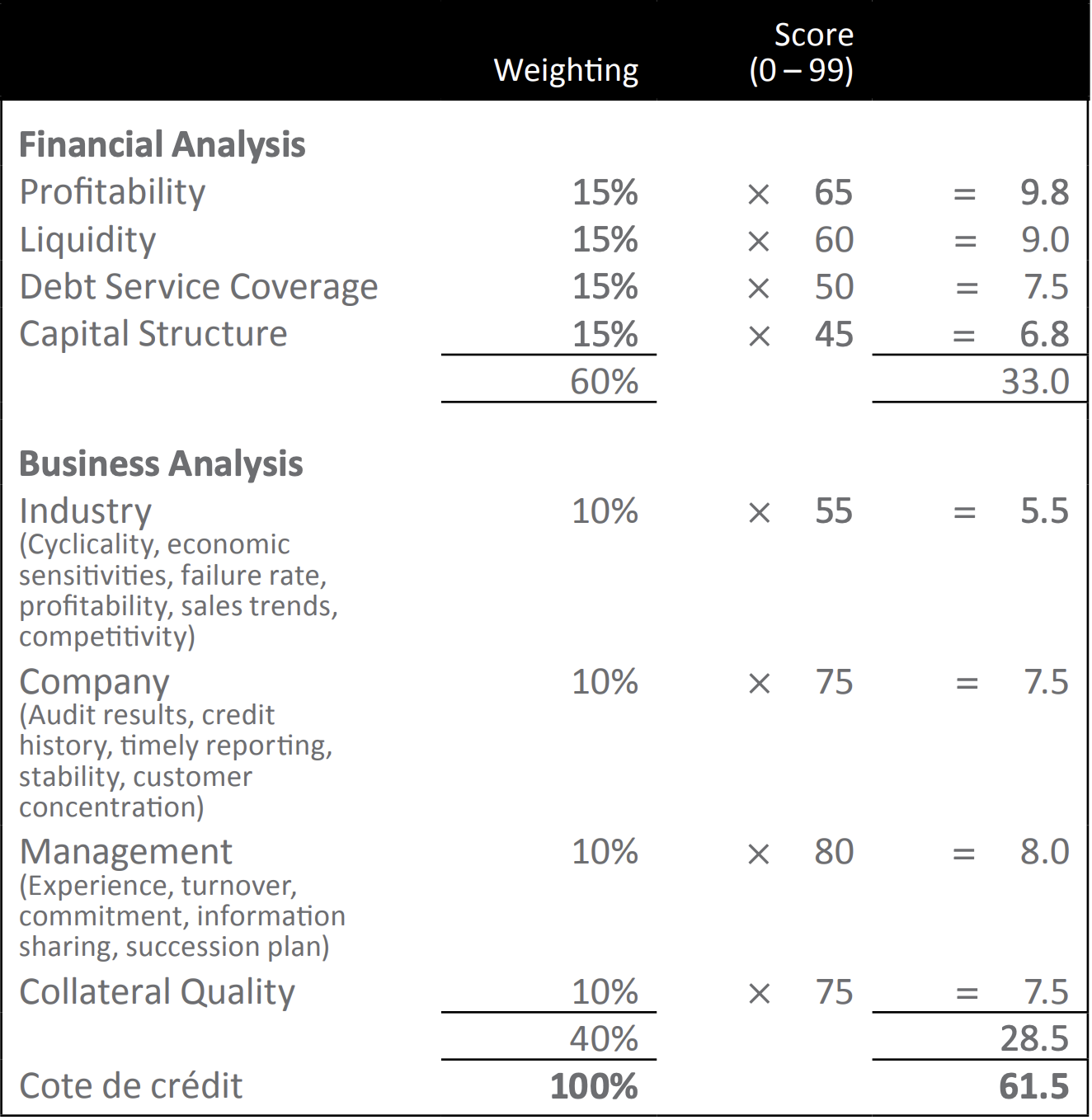

The following is a generic illustration of the process:

Note: The above is a simplistic example with illustrative weighting; actual values will differ from lender to lender as may the scoring scale model sophistication.

Most financial institutions have developed or adapted their own in-house credit analysis systems. Although computational methods and score interpretations may differ from one to the other, they all basically use the inputs we outline above. Your company’s score is driven by objective data as well as some very subjective data gathered from information you will have supplied, information from third parties and from past impressions you may have left in prior dealings.

How does this affect your company?

If your financial ratios are suddenly off, if your sales aren’t moving in the same direction as your competitors, if a risk manager determines your industry will be more severely impacted by the price of oil, exchange rates or housing starts, the system will lower your score. A lower score results in less credit availability, higher interest rates and/or a demand for more guarantees.

On a more global perspective, when the risk prediction models and credit scoring begins diverting from reality as it has in the past few weeks, the result is a banking crisis with similar results: less available credit and higher fees.

What to do?

Much as the present crisis shows that predictive systems are not infallible, they are nonetheless here to stay. Although you will continue to discuss and negotiate credit with your banker, the final lending decision will increasingly be determined by a computer.

Here is some basic advice:

Don’t underestimate the importance of your company’s financial ratios: these are the cornerstone of the credit scoring system.

Diversify your borrowings: each lender has its own scoring system; what may generate a bad score with one lender may not be the same with another.

Human intervention and emotion still play an important role: maintain a positive and transparent relationship with your banker; earning his or her respect can pay off.

Be careful of your company’s credit rating: not paying your bills on time is one of the most important factors that can negatively impact your credit score.

Use a good financial consultant in good times as in bad times.

Stay informed

Subscribe to our newsletters to stay on top of industry news, develop your knowledge and receive relevant, real-time advice.