Export Credit Agencies as a Source of Financing

In today’s tight credit environment, borrowers with viable projects are finding it difficult to convince lenders to open up their wallets, be it for equipment,

project, or even for working capital financing. Our experience indicates that Canadian purchasers all too often overlook Export Credit Agencies as an

alternative source of financing.

What are Export Credit Agencies?

Export Credit Agencies (ECA’s) are governmental or quasi-governmental financial institutions whose missions are to promote external trade. ECA’s act between a seller and a purchaser of goods to provide government-backed loans, guarantees and/or credit insurance. In Canada, the Export Development Corporation (EDC) is a well known reference, but in fact, there are some 70 such agencies around the world promoting and supporting export activities. In 2011 ECA’s collectively supported in excess of US$ 1.76 trillion of financing commitments.

Historically, ECA’s have been used to promote large scale exports (i.e. subsidized exports) and “tied” aid credits to developing economies. Recent formal and informal international agreements have harmonized the use and undertaking of ECA’s with provisions for minimum interest rates, environmental considerations and anti-corruption due diligence. These changes have also made this type of support more readily available for smaller transactions. The financing provided by an ECA can take the form of direct loans or investments, credit insurance and/ or guarantees. The credit may be short, medium or even long term.

How does it work?

There are various ways to structure export credit financing but they basically gravitate around two main themes; the Direct Loan Approach or the Export Finance Guarantee.

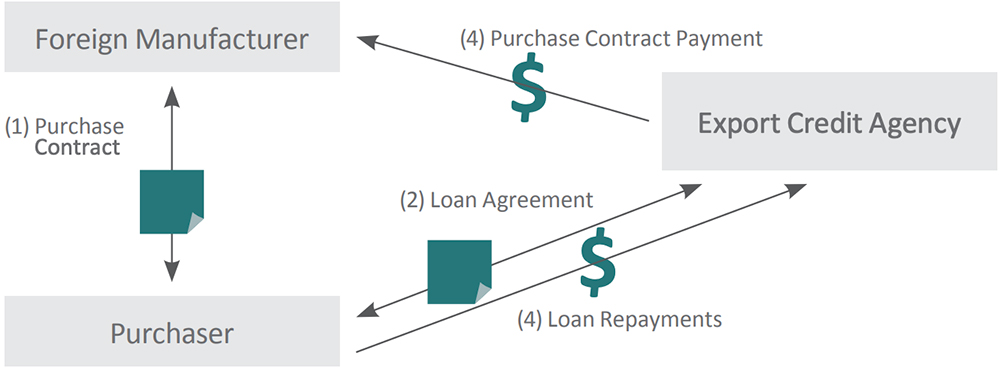

Direct Loan Approach

Assume you have a capital investment project which includes the purchase of foreign manufactured goods and/or equipment. As purchase contract negotiations get underway with the foreign supplier, the buyer and/or the supplier will approach an ECA, usually in the country of origin, to help finance the purchase. The purchaser contracts a loan for the equipment with the ECA who will pay the supplier according to terms of the purchase contract. The purchaser then reimburses the ECA according to the terms and conditions of the loan agreement.

Here is a schematic flow of funds under a direct loan approach.

The terms and conditions of ECA loan agreements differ from transaction to transaction but they generally have a minimum threshold amount with financing usually limited to no more than 85% of the purchase contract value. Terms can extend for up to 15 years while fees and charges, including insurance fees, will be based on risk, term and security. Security typically consists of a pledge on the equipment being financed or similar

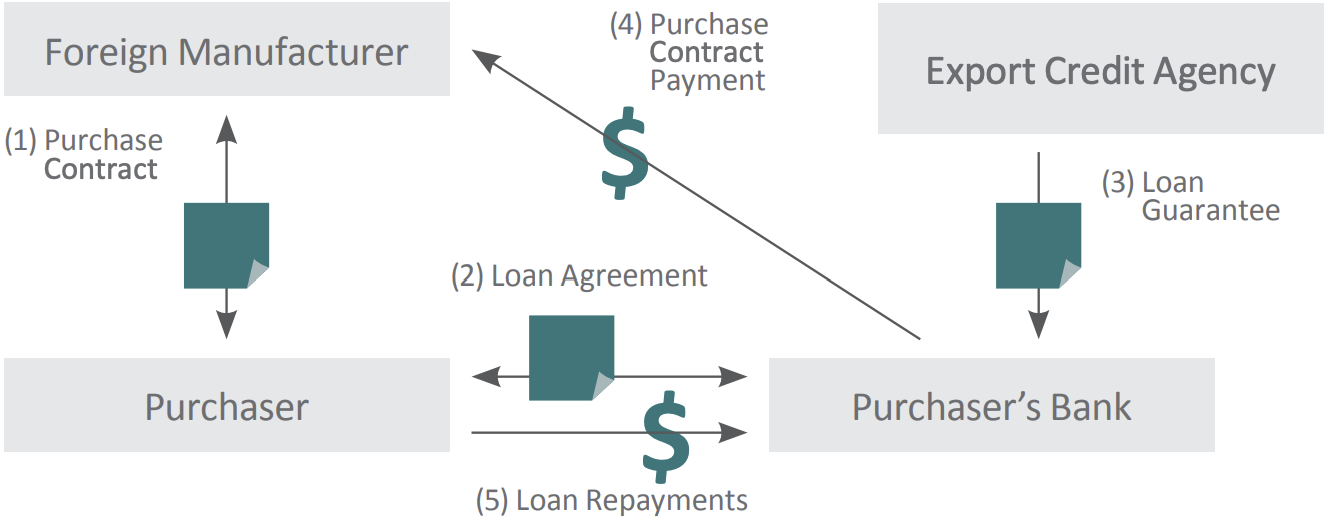

Export Finance Guarantee Approach

Under certain circumstances it may be preferable to use an Export Finance Guarantee Approach whereby the ECA provides a loan guarantee to the purchaser’s local lender. Guarantees offered by ECA’s vary from 75% to 85% of the invoiced transaction value and may reach 95% for technology related contracts. An ECA guarantee can be instrumental in a) helping the purchaser obtain financing, and b) by lowering the lending bank’s risk should result in more favourable lending terms.

Why consider Export Credit Agency backed financing?

ECA backed financing is especially interesting for small to medium businesses because it enables them to enter into transactions normally reserved for larger entities with more extensive commercial and financial resources. For purchasers, ECA financing compensates for domestic credit restrictions, while for vendors it provides an attractive selling feature.

Despite the added cost for insurance premiums charged by an ECA, interest rates remain more than competitive compared to conventional domestic rates especially in sectors where capital is largely non-existent either for contextual or structural reasons. To minimize the impact, the insurance premium, which varies from one country to another, is usually amortized over the duration of the loan.

ECA backed financing is readily available in all 30 OECD member countries. Equipment and/or machinery purchased from suppliers in any one of these countries can qualify for ECA funding. In Canada, Export Development Canada provides ECA financing along with a host of other services.

Considerations

Export Credit Agency backed financing requires some planning and close monitoring. If you are considering this type of option, we strongly recommend you bring the ECA onboard very early in the negotiations. This will allow you to properly assess the value of the available leverage as well as help you and your supplier make sure the commercial terms you have agreed to satisfy the ECA’s minimal requirements.

Cafa has been involved in several transactions involving Export Credit Agencies over the years and would welcome the opportunity to discuss how this type of financing can help you.

Stay informed

Subscribe to our newsletters to stay on top of industry news, develop your knowledge and receive relevant, real-time advice.